A 17-year-old can save on auto insurance coverage by removing unnecessary protection, comparing quotes from numerous insurance providers as well as making the most of discounts commonly provided to teens. Car insurance for teens is notoriously costly, however there are smart methods to conserve significantly. The average cost of cars and truck insurance for a 17-year-old is $737 each month, based on our evaluation of countless rates across nine states (vehicle).

Why is cars and truck insurance policy so costly for 17-year-olds? Young vehicle drivers are expensive to insure due to the fact that they are statistically most likely to enter vehicle crashes as well as as a result represent a higher danger for insurer - auto. This might seem unjust, yet 17-year-old chauffeurs could find some solace in the reality that older, inexperienced chauffeurs additionally pay higher car insurance prices.

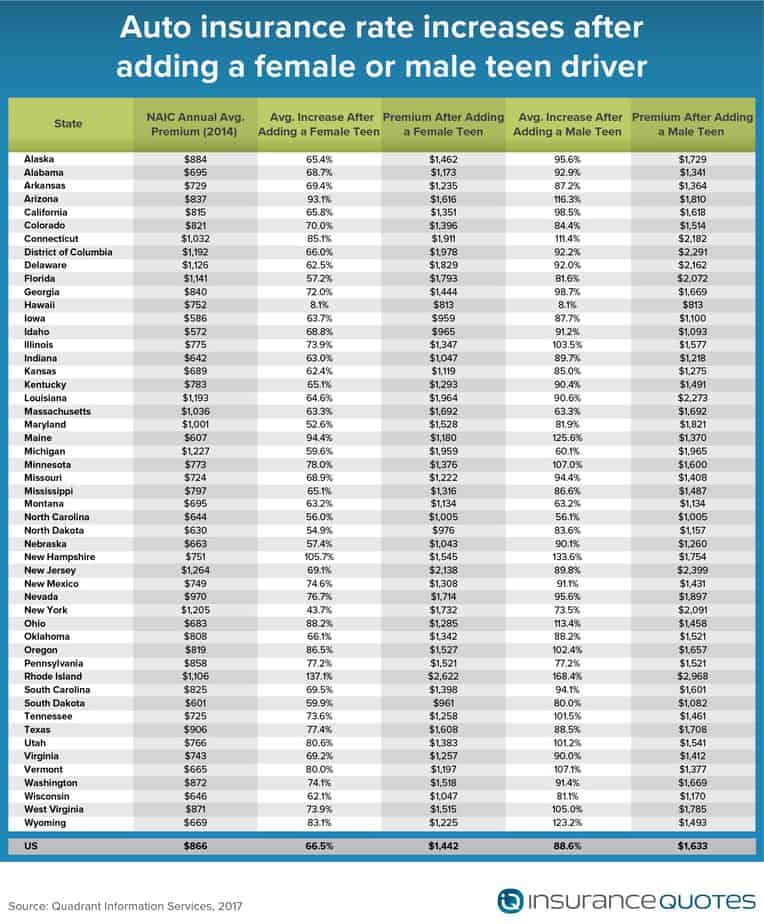

Just how do prices vary in between 17-year-old male and also female drivers? The ordinary cost of auto insurance for 17-year-old male motorists is 9% extra expensive than the standard for women chauffeurs. This is because of the fact that young male vehicle drivers often tend to enter into more mishaps compared to young female vehicle drivers.

16$ 845$ 78218$ 647$ 586 How to save on automobile insurance policy for 17-year-olds The ideal means to minimize automobile insurance coverage for 17-year-olds is to. Additionally, you can guarantee reduced prices by shopping about for quotes, checking out price cuts and also electing for much less coverage. Look around Insurance expenses differ considerably by location. The most effective means to guarantee you obtain the lowest rates is by collecting quotes from several vehicle insurance policy companies in your area.

The even more insurance firms you get quotes from, the more probable you are to obtain the cheapest possible rate. Locate discount rates for 17-year-old vehicle drivers Many insurance providers offer that minimize the high cost of car insurance policy for young motorists. Some insurance firms, such as Progressive, also use a discount rate just for having a young vehicle driver under 18 years of ages on a policy.

cheap car insurance low cost auto insurance car insurance

cheap car insurance low cost auto insurance car insurance

0 Grade point average or "B" average to receive this price cut. The amount saved varies throughout vehicle insurance coverage companies, with some, such as State Farm, using price cuts approximately 25%. may additionally get such a price cut by positioning in the top 20% of their course, or on the dean's listing or honor roll.

The Of Insuring Your Teen Driver For The First Mile

Usually, you obtain a reduced premium upon conclusion of a state-approved motorist's education and learning course, though some insurance companies use their very own driver-education or defensive-driver courses. Discounts generally range from 5% to 15%, depending upon the insurer (cheaper auto insurance). Parents whose children participate in institution much away as well as leave their automobiles in the house can obtain discount rates from some insurance companies.

How to get auto insurance policy for a 17-year-old If you're a parent adding a 17-year-old driver to your policy, obtaining them covered is generally as straightforward as contacting your insurance firm cheapest car insurance or upgrading your plan online. This is the most inexpensive choice for guaranteeing these vehicle drivers, however it might still include a significant premium boost - low cost auto.

Nevertheless, states frequently require a parent to authorize a certification of permission or otherwise give approval before a small can sign up an automobile. Some insurers won't use insurance coverage to a 17-year-old without a parent's trademark. After getting approval, the 17-year-old should find out to collect as well as compare quotes when they're getting an auto insurance coverage.

credit score cheapest auto insurance insurance affordable

credit score cheapest auto insurance insurance affordable

Exactly how to get insurance coverage with a student's permit Teens with are often covered by their parent's plan, and as a result aren't called for to be added as a motorist. This may differ by insurer, so the best means to make sure is to contact your insurance company and allow them know that a teenager with a student's permit will certainly be driving an auto covered by your policy.

Technique Our analysis gathered car insurance prices from thousands of ZIP codes across nine of the most booming states in the U.S. The full-coverage policies that we utilized had the adhering to limitations: Physical injury obligation$ 50,000 per individual/$ 100,000 per crash, Home damage liability$ 25,000 per accident, Uninsured/underinsured motorist bodily injury$ 50,000 per individual/$ 100,000 per crash, Comprehensive and collision$ 500 deductible, Individual injury protection (PIP) Minimum, when required by state Our evaluation covered 29 insurance coverage companies, yet prices from insurance firms were only consisted of in our checklist of ordinary costs and also suggestions if their policies were readily available in at the very least 3 of the 9 states.

cheaper car auto insurance low cost auto automobile

cheaper car auto insurance low cost auto automobile

These prices were publicly sourced from insurance firm filings and ought to be made use of for comparative functions just. Your quotes might differ from the averages detailed in this research study - insurance affordable.

The Ultimate Guide To 17 Year Olds Car Insurance - Compare Quotes At Confused.com

Seventeen-year-old motorists typically have a bit a lot more driving experience than their 16-year-old equivalents, however are still considered relatively inexperienced on the roadway by insurance providers. Average automobile prices for 17-year-old teen motorists show this inexperience as well as their above-normal accident regularity and are fairly a bit higher compared to other age teams. auto insurance.

For contrast, the average expense of complete coverage car insurance coverage in the U.S. is $1,674 per year. Due to the fact that 17-year-olds are still minors and also can not buy a policy themselves, this costs shows the distinction in rate to add the teen to their parents' policy, not the complete cost of the policy.

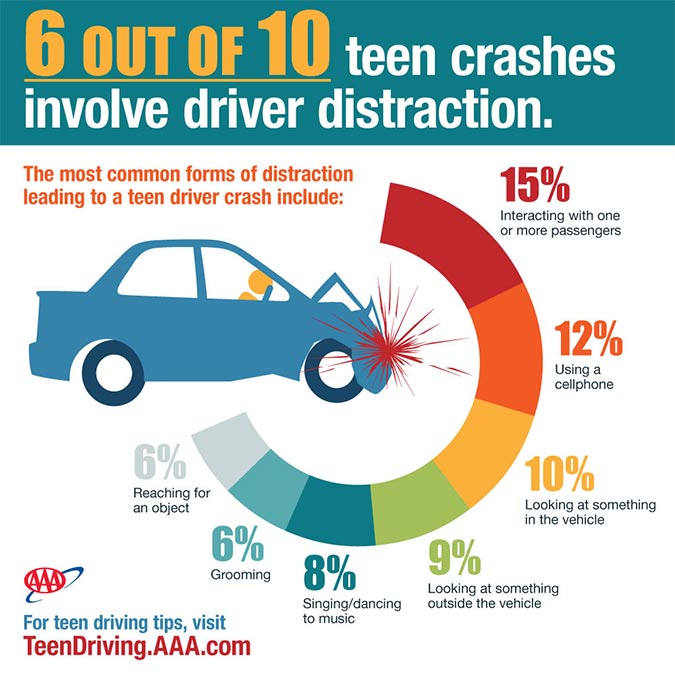

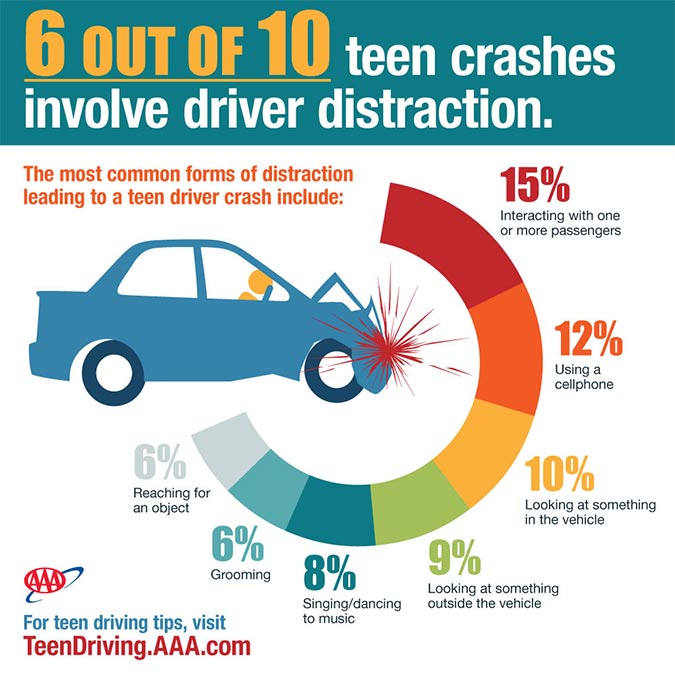

, teens between the ages of 16 and 19 are at a better risk of auto mishaps than any various other age team. Given that there is a higher probability that teen drivers will certainly create accidents, insurance policy carriers bill even more to cover them.

The table listed below highlights the ordinary annual full insurance coverage car insurance costs for 17-year-old males as well as ladies by state. Insurance provider are not allowed to utilize sex in identifying vehicle costs in 7 states. Your costs will also likely vary by the city and also the specific postal code you reside in; some cities are a lot more costly for parents of teenager vehicle drivers - cheap car.

Nationwide does have a lower-than-average insurance claims satisfaction score from J.D. Power, however, which suggests that current customers may be less than satisfied with the service provider's insurance claims process.: Nationwide Insurance evaluationState Farm, For teens whose moms and dads like to keep all their plans in one place, State Ranch may be a great option.

Just how to reduce cars and truck insurance when insuring a 17-year-old, Although the price to insure an adolescent motorist can be scary, there are many ways to conserve cash. The majority of insurer offer car insurance coverage price cuts for trainees to assist you offset the superior rise you will likely experience after adding your 17-year-old driver.

All About Temporary Car Insurance For 17 Year Old - Tempcover

Among the most effective methods to find the best business for you is to comprehend your demands and look around. Evaluating quotes from multiple insurance provider as well as comparing price cuts and also coverage types can aid you find the appropriate plan for your demands. Should I change my protection when adding a teen motorist? Including a teen can boost your premium significantly, and also it can be tempting to reduced insurance coverage degrees or get rid of whole protection types to save cash.

cheapest car cheapest auto insurance insurance companies perks

cheapest car cheapest auto insurance insurance companies perks

Older teens will likely pay a higher premium on their very own plans than if they remain on their parents' plan. As long as your teen resides in your household or survives an university university, your insurance coverage firm will likely permit them to remain on your plan, and also they will be called for to remain on your plan as long as they are driving a lorry you possess.

As a result of mishap statistics, the price of replacement parts and also labor and offered safety and security attributes, some vehicles are less expensive to guarantee than others. If you are searching for a vehicle for your teen, a lot of insurance professionals recommend that you obtain insurance quotes for the lorry prior to you buy it. By doing this, there are no surprises when you include the lorry and also your teenager to your plan, as well as you have a more clear photo of the monetary effects of a particular vehicle for your teenager - credit score.

The best method to lower your teenager's cars and truck insurance coverage price is to include them to your existing insurance coverage policy if they currently have their own and after that seek discounts to further decrease the cost - car insurance. Other remarkable means to lower the price of adolescent auto insurance include minimizing your teen's protection as well as obtaining numerous quotes.

Reduce coverage Considering exactly how pricey cars and truck insurance coverage is for young motorists, your teenager could conserve on their costs by restricting the amount of insurance coverage they include on their policy.

vehicle insurance car insurance insure money

vehicle insurance car insurance insure money

Obtain multiple quotes The ideal method to lower teen car insurance policy is to look around for quotes from at the very least 3 different providers, particularly if your young adult is getting their very own policy. insure. Every insurance firm utilizes their own methods to calculate costs, so the rate that you receive from one company may not coincide as one more.

A Biased View of Teen Driving - National General Insurance

To figure out where to start, check out Wallet, Hub's choices for the best teen cars and truck insurance provider. You can likewise locate even more info in our guide on how to reduce car insurance prices (accident).

When it concerns insurance, it pays to be a safe driver. Teenager drivers currently pay even more for cars and truck insurance coverage than even more experienced chauffeurs, and also if you're not complying with the customary practices, your prices will be also greater - money. Insurance provider consider teenagers a higher risk, due to the fact that unskilled drivers are far more most likely to enter into crashes.

See to it you're contrasting the same protections when you're looking around. Why do I need auto insurance? Because its the legislation - affordable auto insurance. In North Carolina, you are called for to have car liability insurance coverage to legally drive. Due to the fact that it assists you secure yourself monetarily. If you cause a crash, insurance policy helps spend for injuries and residential or commercial property damage you trigger to others.

If you drive without insurance coverage ... You could be ticketed and fined. As a moms and dad, how can I maintain my teen motorist secure? If you are a parent of an adolescent chauffeur, your kid's safety is your first worry.

While teenager driving data are uncomfortable, research study suggests parents who set guidelines cut mishap risk in fifty percent - cheaper auto insurance.

Something failed. Wait a minute and also attempt again Attempt again - cars.

Things about Progressive Teen Car Insurance: What It Will Cost You - Buyerlink

Having a teen driver can get pricey, promptly. Possibly one of those young drivers is your teen! Parents and guardians require to take the time to speak to teen chauffeurs regarding the seriousness of driving safely. Teens must comprehend that driving is an advantage as well as if treated lightly it can result in raised premiums as well as pricey repair costs, and also at worst reckless actions behind the wheel might cause their death or the deaths of others.

com utilized a family members account of having a 2019 Honda Accord driven by a 40-year old male buying complete coverage. They added a 16-year old teenager to the plan. This is what they saw take place to the rates: The typical household's automobile insurance expense climbed 152%. An adolescent boy was much more expensive.